Why Lease When You Can Own? Rooftop Solar Facing Tough Question

May 24, 2016 — 7:00 PM EDT Updated on May 25, 2016 — 9:24 AM EDT

It’s tough to argue with free. That’s why the no-money-down solar lease became the most popular choice for U.S. rooftop power.

Now, though, the equation is changing. Falling costs are making it easier for consumers to buy solar systems outright, and banks and solar installers are promoting loans with no upfront payments. That’s a threat to companies such as SolarCity Corp., Sunrun Inc. and Vivint Solar Inc., which built their businesses on people signing decades-long contracts.

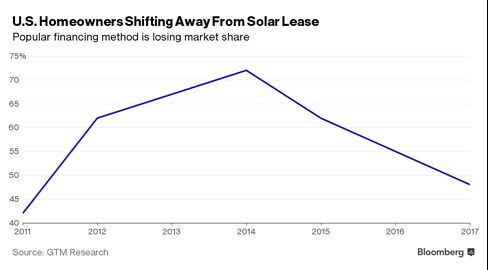

Installation growth is slowing for the big three U.S. rooftop solar installers, and GTM Research, an industry consultant, is forecasting the percentage of consumers buying rather than leasing residential systems will expand to 45 percent this year, from 38 percent in 2014. Shares in all three companies have plunged more than 40 percent this year, for a variety of reasons including a failed acquisition bid for Vivint and questions about SolarCity’s strategy.

“Leasing was the major game but that’s changing quickly,” said Patrick Jobin, an analyst at Credit Suisse Group AG. “Consumers are starting to realize there are better options.”

Greg Gill, a retired IBM employee, was looking for ways to cut his $400 monthly utility bill. He considered leasing, but decided in the end to pay $32,370 for a 7.3-kilowatt system that was installed in September at his home outside Sacramento.

Gill charged it on a credit card (to earn rewards) and then paid it off in cash, he said. His April utility bill was $1.18, he earned a $10,000 tax credit and he’s expecting an 11 percent return on the investment.

“A tree-hugger friend of mine was dead-set on SolarCity,” Gill said. After talking to five installers, he crunched the numbers and concluded that buying was a better deal.

“It really was a no brainer,” he said. “Even if you financed it at 3 percent, you still come out ahead over leasing.”

He’s not alone. By next year, customers who own their systems will make up the majority of the U.S. residential solar market for the first time since 2011, according to Boston-based GTM. Third-party companies, mainly lease providers, will account for the rest. And that shift is accelerating. Last July, Nicole Litvak, a GTM analyst, predicted that owning wouldn’t become the top choice until 2020.

Leasing companies are aware of the trend, including SolarCity, the biggest U.S. rooftop installer, which rolled out a no-money-down loan program this month. That replaced a more complicated financing program introduced in 2014 that ended this year.

“We anticipate loans will continue to be very popular,” Kady Cooper, a spokeswoman, said by e-mail. The financing deals offer returns to SolarCity that are comparable to leases, she said, in part because the company’s volume helps it negotiate terms with lenders. A 10-year loan comes with a 2.99 percent fixed interest rate, and 20 years gets 4.99 percent.

Slowing Growth

SolarCity’s growth is slowing. It expects to install about 1 gigawatt of panels this year, about 15 percent more than last year. In February, the company said 2016 installations would increase as much as 40 percent.

Vivint announced in November that it was offering loans in Utah, its home state, through a partnership with the financing company Solar Mosaic Inc., with plans to expand to other states.

“There is some increasing demand from customers that would like to own their own system,” Casey Briggs, a spokeswoman, said in an e-mail, though leases remain “the primary driver in the market for residential solar.”

At Sunrun, leasing will make up about 80 percent of its business in the fourth quarter, down from 85 percent now. It introduced a loan program in September. The San Francisco-based company installed 60 megawatts of panels in the first quarter, up 63 percent from a year earlier. In the fourth quarter, it added 68 megawatts, an 83 percent increase from the same period a year earlier.

Ownership offers advantages over leases, said Jeffrey Osborne, an analyst at Cowen & Co. Consumers don’t get entangled in decades-long contracts, and because they own the panels they get all tax benefits and other incentives.

“When I put solar on my house it made so much more sense to buy,” Osborne said. Leasing “made a lot of sense in the beginning. Now that there are a million solar rooftops, banks are more comfortable” financing the systems.

Installers say consumers are showing more interest in owning the panels on their roofs.

“We’re definitely taking market share,” said Jim Nelson, chief executive officer of Sunworks Inc. “If you buy a solar system outright with cash, the benefits are twice as good as with leases.”

The Roseville, California-based installer helps customers line up financing. While it’s nowhere near the size of SolarCity -- revenue this year is expected to almost double to $99 million -- Sunworks has been profitable in two of the past three quarters, while the leasing giant has reported only three profitable quarters since its December 2012 initial public offering.

Leasing Rebound

Leasing companies expect demand for the financing tool to rebound when the federal Investment Tax Credit expires for homeowners, said Ed Fenster, Sunrun’s chairman and co-founder.

That’s the 30 percent tax break that helped make ownership more appealing to Gill, the IBM retiree. After 2023 it will no longer be available to consumers, though leasing companies will continue to qualify for a 10 percent credit.

“That’s enough of a driver to encourage consumers to lease,” Fenster said in an interview.

As costs continue to come down, ownership will make more and more sense, said GTM’s Litvak. Consumers will save money from day-one, even if they borrow to pay for the systems.

“It won’t be long before you can just put it on a credit card,” Litvak said in an interview by phone. “It just makes more sense economically than leasing.”